Phoenix Capital Group Reviews: What Customers Say About Their Services

Introduction

Phoenix Capital Group is one firm that says it can provide these services.Freight bill factoring, equipment finance, and working capital loans are just some of the financing and factoring solutions offered by Phoenix Capital Group.The company claims it can aid businesses in expanding thanks to a variety of services, including quick finance, affordable rates, online account management, a gasoline card programme, and more.

Don’t, however, believe everything they say. How do their regulars rate their assistance? Some of the testimonials and comments that Phoenix Capital Group’s clients have left for the company are presented here. We will also outline the Phoenix Capital Group application process and describe the services we provide.

Services offered by Phoenix Capital Group

Freight bill factoring, equipment financing, and working capital loans1 are the three major services provided by Phoenix Capital Group to enterprises. A quick rundown of each offering is as follows:

- Freight bill factoring: This technique, known as “freight bill factoring,” helps trucking companies collect on their freight invoices more quickly. Trucking businesses can sell their goods bills to Phoenix Capital Group, and they will be paid up to 95% of the invoice amount within 24 hours. This helps trucking companies boost their cash flow, lower their credit risk, and concentrate on what they do best. Fuel cards from Phoenix Capital Group can be used at any of the more than 8,000 participating petrol stations across the country, providing significant savings for trucking companies.

- Equipment financing: Businesses who require financing for the acquisition or lease of machinery, vehicles, or trailers can benefit from this service. Flexible periods and low interest rates are offered by Phoenix Capital Group for financing or leasing equipment. There is no initial payment required, and the company will finance up to 100% of the cost of the equipment. Customers can apply for equipment financing using Phoenix Capital Group’s online site, where they can also monitor their loan progress and make payments.

- Working capital loans: When a company needs money for things like payroll, taxes, maintenance, etc., they can turn to working capital loans. Companies that have been operating for at least six months and have $100,000 in yearly revenue are eligible for a short-term loan from Phoenix Capital Group. The organisation offers fast, collateral-free loans of up to $250,000 in as little as 24 hours. Flexible payment terms and cheap origination fees are two more benefits of working with Phoenix Capital Group.

How to apply for Phoenix Capital Group’s services

The application process at Phoenix Capital Group couldn’t be simpler.The company accepts applications via its website or over the phone. The procedures for signing up for each service are as follows:

- Freight bill factoring: Customers interested in goods bill factoring must complete a short online application and attach supporting papers (such as an authority letter, insurance certificate, W-9) before receiving funding.A client list and invoice history is also required. The application will be reviewed by Phoenix Capital Group, and the customers’ credit will be checked. After being given the green light, clients can send in their invoices electronically (through email or fax). Up to 95% of the invoice amount will be paid within 24 hours via direct deposit or wire transfer by Phoenix Capital Group. Once the consumer pays the invoice in full, the outstanding balance will be paid.

- Equipment financing: To apply for financing for equipment, customers must fill out an online application, where they must reveal information about their company.Information regarding the piece of machinery or vehicle that they wish to finance (such as its brand, model, year, mileage, price, etc.) is also required. The application will be reviewed by Phoenix Capital Group, who will also check the applicant’s credit. Customers who are authorised for a loan or lease will be sent an agreement to sign and return. After that, Phoenix Capital Group will either pay the equipment vendor directly or issue a refund to the buyer.

- Working capital loans: Customer information such as business name, address, phone number, email address, annual income, etc. is required for working capital loans. They must also integrate their company’s banking system with Phoenix Capital Group’s digital hub. The financial standing and credit history of the company will be evaluated by Phoenix Capital Group. Customers who pass the credit check will be provided a loan offer they can accept or decline. If clients agree to the terms, Phoenix Capital Group can have the loan funds in their account as soon as the following business day.

Customer testimonials and feedback on Phoenix Capital Group’s services

Customers who have used Phoenix Capital Group’s services have given the company high marks.The following are a few examples of client feedback posted on sites like Trustpilot, the Better Business Bureau, and Google:

- Freight bill factoring: Customers who have used Phoenix Capital Group’s goods bill factoring services have praised the company’s speed and ease of funding, as well as its helpful personnel, fair rates, and online portal for monitoring invoices and payments. One satisfied client commented, “Phoenix Capital Group has been a great partner for our trucking company.” We were able to increase our profits and stabilise our cash flow with their assistance. Their rates are reasonable and their service is reliable and kind. Their website is simple and quick to navigate.Anyone in need of a trustworthy factoring company has our highest recommendation.

- Equipment financing: Phoenix Capital Group’s equipment financing services are highly regarded for their speed, adaptability, competitive interest rates, lack of red tape, and polite staff. One happy client shared, “Phoenix Capital Group assisted us in obtaining financing for a brand new truck to add to our fleet. They were incredibly accommodating, and we got a fantastic deal. Our loan was authorised the next day, and we were able to pay the vendor without any delays. We were offered a manageable interest rate and various repayment options. We had a lot of questions, and they were able to address them all. Our time working with them has been excellent.

- Working capital loans: Customers that have used Phoenix Capital Group for working capital loans have praised the company for its speedy loan approvals, reasonable interest rates, and helpful staff. One client stated, “We received a working capital loan from Phoenix Capital Group, which allowed us to pay for some unforeseen expenses.” They processed our loan application quickly and directly deposited the funds into our account. The financing rate and origination fee they provided were likewise competitive. Their follow-up and dedication to us as customers were exceptional.Our experience with them has been excellent.

Conclusion

In this post, we investigated the services provided by Phoenix Capital Group and compiled feedback from their clientele.According to our research, Phoenix Capital Group is a financial services firm that helps companies get the money they need through services like goods bill factoring, equipment finance, and working capital loans1.Phoenix Capital Group provides its clients with a number of advantages, including quick funding, competitive interest rates, convenient online account administration, a fuel card programme, and more.

We also found that previous clients of Phoenix Capital Group had nothing but good things to say about the quality of their service.Phoenix Capital Group has received high marks from satisfied clients for its speedy funding procedures, user-friendly website, courteous service team, clear pricing structure, and convenient payment tracking portal.Phoenix Capital Group is well-liked by its clientele because of its prompt and versatile financing alternatives, reasonable interest rates, small administrative burden, and friendly service.Phoenix Capital Group’s customers also rave about the company’s fast loan approval times, low rates, and friendly service.

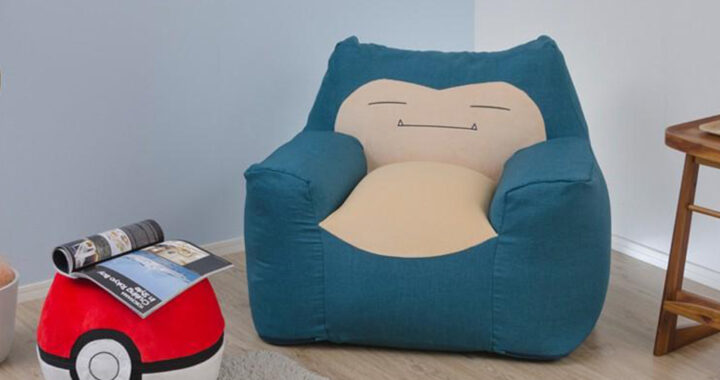

Relax and Game with the Gengar Bean Bag Chair

Relax and Game with the Gengar Bean Bag Chair  GenYouTube: Your Ultimate Online Video Downloading Tool

GenYouTube: Your Ultimate Online Video Downloading Tool  MPress Heat Press: The Perfect Solution for Customizing Your Apparel

MPress Heat Press: The Perfect Solution for Customizing Your Apparel  Abeychain: The Future of Blockchain Technology?

Abeychain: The Future of Blockchain Technology?  How to Fix Common Problems with Your Vevor Heat Press Machine

How to Fix Common Problems with Your Vevor Heat Press Machine  The Benefits of Using Compressa Knee Sleeve for Knee Support and Relief

The Benefits of Using Compressa Knee Sleeve for Knee Support and Relief  Movierulz 2026: Risks, Reality, and Safer Alternatives

Movierulz 2026: Risks, Reality, and Safer Alternatives  Top Networking Events in Atlanta 2023

Top Networking Events in Atlanta 2023  Lighten the Mood: Hilarious Work Meeting Jokes

Lighten the Mood: Hilarious Work Meeting Jokes  Exploring Movierulz 2024: Safe Download Tips

Exploring Movierulz 2024: Safe Download Tips