Buying Your First Home: 9 Essential Steps

Woman holding a key for a house on a keychain in front of a brick house

Buying your first home is exciting, and nerve-wracking, all at once. There are so many considerations to be made before starting the process of purchasing a home on your own for the first time.

The process of homebuying can seem very complicated. You may be wondering what is involved in buying a first home, and how you can be prepared for it.

There are a few things you can do in advance to make your first home-buying experience as smooth as possible. Here is a list of nine essential steps that you should follow when buying your first home.

1. Find the Right Real Estate Agent

Looking for a real estate agent to help you buy your first home? Keep these tips in mind to help you find the right real estate agent for you.

First, do your research. Check out potential real estate agents online, and read reviews from past clients. Once you’ve narrowed down your options, set up meetings with a few agents to get a feel for their personalities and see if you click.

Second, ask the right questions. When meeting with real estate agents, be sure to ask about their experience working with first-time home buyers, their knowledge of the local market, and their negotiation strategies.

Third, be upfront about what you’re looking for. The more information you share with your real estate agent, the better they’ll be able to help you find your dream home.

2. Get Pre-Approved for a Mortgage Loan

For most people, buying their first home is the biggest financial decision they will ever make. It is important to get pre-approved for a mortgage loan before you start looking for a home. A pre-approval letter from a lender will tell you how much particular money you can possibly borrow and give you an idea of what interest rate you will be charged.

3. Start Searching for Your Dream Home

The search for a new home is an exciting but also stressful time. You may be looking for your first home, or perhaps you are upsizing or downsizing. Whatever the case, there are a few things to keep in mind as you start your search.

First, be clear on your budget and what you can afford. It is easy to get caught up in the excitement of finding a new home and overlook your financial limitations. Be sure to get pre-approved for a mortgage and have a realistic idea of what your monthly payments will be.

Second, think about your must-haves versus your nice-to-haves. What are the features of a home that are non-negotiable for you? What would be nice to have but is not essential? This will help you focus your search and narrow down your options.

Finally, be prepared to compromise. It is unlikely that you will find a home that perfectly meets all of your criteria. Be open to making some compromises in order to find the right home for you.

4. Make an Offer on a Home

The purchase offer is a contract to buy a home. Its important to have an attorney review the contract before you sign it. Once the offer is signed by both the buyer and the seller, its a legally binding document.

The purchase offer will include the purchase price, any contingencies, and the proposed closing date. The contingencies should be realistic and achievable. For example, a common contingency is the successful completion of a home inspection.

Once the offer is submitted, the seller will have three options: accept the offer, reject the offer, or make a counteroffer. If the seller makes a counteroffer, the buyer can accept, reject, or make a counteroffer of their own. This back-and-forth can continue until both parties agree on the terms of the sale.

5. Get a Home Inspection

Home inspections are critical when purchasing a home especially your first home. Make sure to schedule a home inspection as soon as you have an accepted offer on a home.

The home inspection will help identify any major defects or repairs that need to be made. Its important to be aware of these things before you purchase a home so that you can budget for the repairs. If the repairs are too costly, you may decide to walk away from the deal.

6. Obtain Financing

Once the purchase price is agreed upon, you’ll need to obtain financing. The loan process can take several weeks, so it’s important to be patient. Once you have your loan, you’ll need to sign a purchase agreement and close on the loan.

7. Get Insurance for Your New Home

Home insurance will protect your home and belongings in the event of a fire, theft, or other disasters. You will also need to insure your home against liability in the event someone is injured on your property. Once you have your insurance in place, you can relax and enjoy your new home knowing you are protected.

Check out LoPriore Home Insurance for more information on how to get your home insured.

8. Attend the Closing

You’ve found the perfect home and your offer has been accepted. Congrats! The next step is attending the closing, where you’ll sign the paperwork and officially become the owner of your new home.

Once you’re at the closing, the seller will sign over the deed to the property and you’ll sign all the mortgage paperwork. Then, the keys are officially yours!

9. Move Into Your New Home

The day you move into your new home is both an exciting and nerve-wracking day. After all the hard work of finding and buying your first home, it’s finally time to move in and start making it your own.

Be sure to pack essentials like toiletries and bedding so you’re not scrambling to find things when you move in. And don’t forget to change your address so you can start receiving your mail at your new home.

Buying Your First Home

If you’re thinking of buying your first home, congratulations! This is a huge accomplishment.

The process can be daunting, but with the right preparation and guidance, you can do it. A great first step is to contact a real estate agent to start looking at homes within your budget. They can help you navigate the process and make sure you find the perfect home for you.

For more helpful guides, check out the rest of our website.

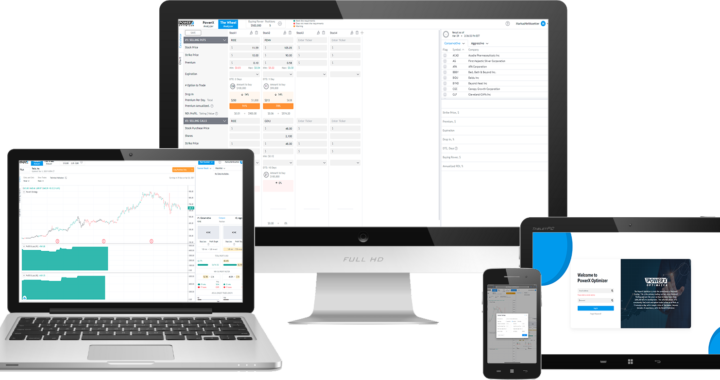

PowerX Optimizer: The Ultimate Software for Finding and Executing Winning Trades

PowerX Optimizer: The Ultimate Software for Finding and Executing Winning Trades  Monument Traders Alliance Reviews: Is It Worth Joining?

Monument Traders Alliance Reviews: Is It Worth Joining?  How to Track IRS Refunds Using Cloud Tax Preparation Software

How to Track IRS Refunds Using Cloud Tax Preparation Software  A Quick Kitchen Remodel Checklist

A Quick Kitchen Remodel Checklist  5 Common Move-Out Cleaning Mistakes and How to Avoid Them

5 Common Move-Out Cleaning Mistakes and How to Avoid Them  6 Office Window Cleaning Mistakes and How to Avoid Them

6 Office Window Cleaning Mistakes and How to Avoid Them  Movierulz 2026: Risks, Reality, and Safer Alternatives

Movierulz 2026: Risks, Reality, and Safer Alternatives  Top Networking Events in Atlanta 2023

Top Networking Events in Atlanta 2023  Lighten the Mood: Hilarious Work Meeting Jokes

Lighten the Mood: Hilarious Work Meeting Jokes  Exploring Movierulz 2024: Safe Download Tips

Exploring Movierulz 2024: Safe Download Tips