Techvestor: A Legit Way to Invest in Airbnb Properties?

Have you ever wished that you had a vacation house that brought in money while you relaxed? If that’s the case, you may be interested in the recent surge in popularity of investing in short-term rental (STR) homes. Known as Techvestor, it’s an online resource that streamlines the process of purchasing Airbnb rental homes. We’ll go through what Techvestor is, how it operates, and why investing in Airbnb homes via them is a good idea because of the passive income, tax advantages, and high returns they provide.

Passive income

Passive income is one of the key benefits of investing with Techvestor. This implies that you will not be responsible for purchasing, supervising, or maintaining the STR properties. Find the best bargains, negotiate the contracts, equip and decorate the apartments, post and sell them on Airbnb, manage reservations and guest communication, clean and refill supplies, and handle any difficulties or repairs; Techvestor does it all. You may just relax and wait for the money to come in.

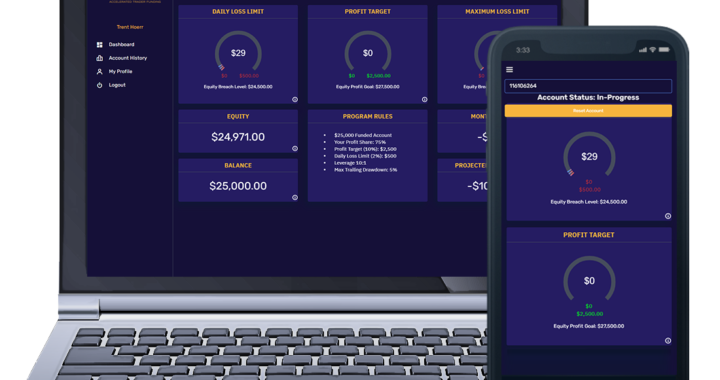

How much money do you think Techvestor will provide you? It all relies on things like the properties’ locations, sizes, and occupancy levels. On the other hand, Techvestor claims a quarterly cash flow of $2,500 per property. That implies you may make $25,000 every three months with no effort at all if you invest in 10 houses. That’s really not that awful!

The advantages of passive income are easy to see. You will have more options in terms of lifestyle, safety, and independence. The time you save might be better spent doing the things that bring you joy, such as spending more time with loved ones, pursuing interests, seeing the globe, etc. You may relax better knowing that you have a reliable revenue stream that doesn’t rely on any particular action on your part.

Tax benefits

Investing with Techvestor might also help you minimise your tax liability. In order to minimise your tax burden and maximise your tax savings, Techvestor employs a number of methods. The following are examples of such methods:

- Forming limited liability companies (LLCs) for each property is an excellent way to divide your company and personal finances.

- You may reduce your taxable income by making a depreciation claim on the buildings and the furnishings.

- Utilising cost segmentation to speed up the write-off of capital expenditures on things like appliances, fixtures, flooring, etc.

- Taxes may be deferred between the sale of one property and the purchase of another by using the 1031 exchange.

- After deducting things like mortgage interest, property taxes, insurance, utilities, upkeep, fees, etc., the net profit from a STR investment should look something like this.

How much do you anticipate saving in taxes by using Techvestor? Again, this is conditional upon a number of variables, such as your income, tax bracket, and local regulations. However, Techvestor claims a yearly tax savings of $5,000 per home. That translates to a yearly tax savings of $50,000 if you own ten investment homes. How much is that?

The value of reducing one’s tax burden is obvious. You’ll be able to hang on to more of your money, which you can then put to use buying additional real estate or other assets. Investing in a variety of sectors and marketplaces may help spread your risk and increase your returns.

High returns

High returns are the third benefit of investing with Techvestor. Techvestor optimises the STR properties’ income and profits via the use of data, technology, and design. Techvestor does this in a number of ways.

- Using big data analysis to find the most lucrative short-term rental (STR) areas, neighbourhoods, and properties

- Pricing, occupancy, and seasonality may all be improved with the use of AI and machine learning.

- Making visually appealing media to advertise the hotels and maybe bring in more customers.

- Using automation and smart home technology to improve the stay for visitors and cut down on expenses.

- Increasing visitor happiness and loyalty via the provision of high-quality facilities and services.

When investing in Techvestor, what kind of return can one anticipate? Again, it is conditional upon a number of variables, including the asking price, rental revenue, and maintenance costs of the properties. However, Techvestor claims a 25% annualised return on investment for their typical home. To put it another way, if you invest $100,000 in a single property, you may expect a yearly return of $25,000. Wow, what a profit!

It’s easy to see why large yields are beneficial. More money can be made, and objectives can be accomplished more quickly. Using compound interest, your wealth may increase tremendously over time.

Conclusion

Because of the passive income, tax advantages, and high returns it provides, Techvestor is a legitimate option to invest in Airbnb homes. Techvestor takes care of everything, from sourcing and maintaining properties to minimising tax liability and maximising earnings. You need just put your money to work for you.

Visit Techvestor’s website to get an invite to their platform or find out more about investing with them. But act fast; availability is tight and interest is great. Join Techvestor now and be a part of the future of STR investing!

The Ultimate Guide to Choosing the Perfect Retirement Community

The Ultimate Guide to Choosing the Perfect Retirement Community  What is FTMO Referral and How Does it Work?

What is FTMO Referral and How Does it Work?  How Monetarifund Can Help You Master Trading in 2023

How Monetarifund Can Help You Master Trading in 2023  SurgeTrader Audition: A Simple Way to Start Trading

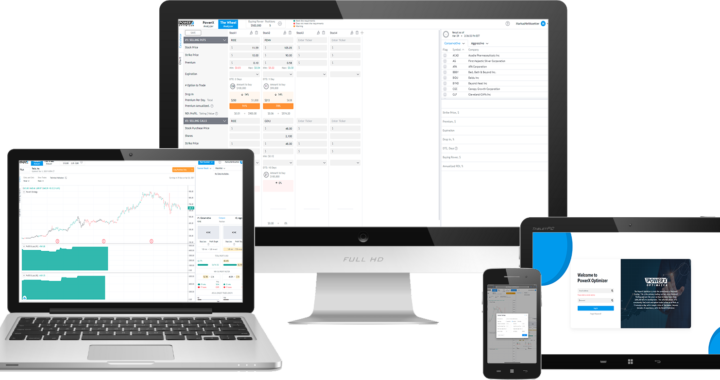

SurgeTrader Audition: A Simple Way to Start Trading  PowerX Optimizer: The Ultimate Software for Finding and Executing Winning Trades

PowerX Optimizer: The Ultimate Software for Finding and Executing Winning Trades  Monument Traders Alliance Reviews: Is It Worth Joining?

Monument Traders Alliance Reviews: Is It Worth Joining?  How to Identify When Your Roof Needs Cleaning: Signs to Look For

How to Identify When Your Roof Needs Cleaning: Signs to Look For  Best Image Editors for Your Mac in 2024

Best Image Editors for Your Mac in 2024  How to Start a Water Purification Business: A Comprehensive Guide

How to Start a Water Purification Business: A Comprehensive Guide  Stacey Dash Net Worth: Unveiling Her Financial Success

Stacey Dash Net Worth: Unveiling Her Financial Success