How to Track IRS Refunds Using Cloud Tax Preparation Software

The cloud allows tax professionals and clients to work from anywhere in the digital age. This saves time for both sides and makes documentation much faster. Good professional software automatically updates to keep up with changes in the tax code. It also has robust security measures that safeguard data. With the right tax software, it’s possible to make filing your taxes a breeze. The best tax software helps you organize your information, calculates your taxes, and provides guidance and support. It’s also easy to file taxes anywhere you can access the internet. This includes mobile devices so you can get tax help on the go.

Track Your Refund

Most cloud-based DIY tax preparation software comes with a handy tool to track your refund. Some also offer free tax assistance or a fun interactive game that helps you learn more about your taxes. One of the most extraordinary things about TaxAct online software is that it automatically backs up your data on secure servers.

This is a considerable advantage over desktop programs that require you to download updates from their servers and risk losing information if something goes wrong. You don’t have to worry about losing all your important documents if your computer crashes or your hard drive dies. Another reason you should use cloud-based tax preparation software is because it has the best possible security features and a robust support system. That’s because it features tools and functions that are easy to use and convenient to access from anywhere.

This is especially important if you have sensitive or confidential personal or business financial data. This type of software is so secure and reliable that it’s a top choice among consumers needing a stress-free way to file their tax returns. The best option is to find a reputable tax preparation software provider that has been around for a while and offers customer service support. Cloud-based DIY tax preparation software can help you get your taxes done faster. It automates much of the process and will ensure your return is accurate and follows the latest tax laws.

Many of these programs offer free options for simple tax returns that don’t include complicated deductions or credits. Some even have a maximum refund guarantee. Most cloud-based DIY tax preparation software programs offer a free tier for filing simple returns with few credits or deductions. Some will charge an extra fee for complicated tax situations. However, hiring a tax professional may be worth it if you have complex concerns like self-employment income, itemized deductions, or investments.

Check the Status of Your Refund

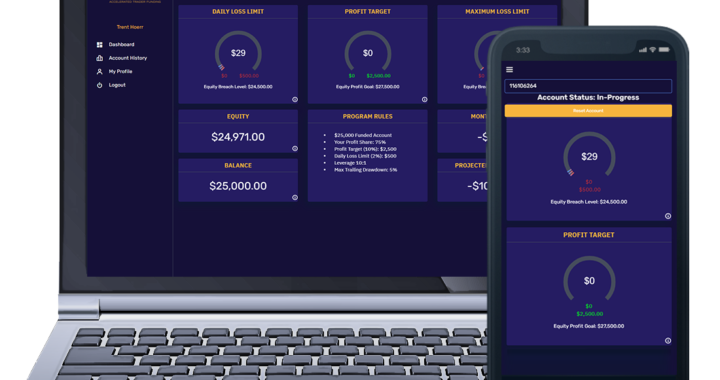

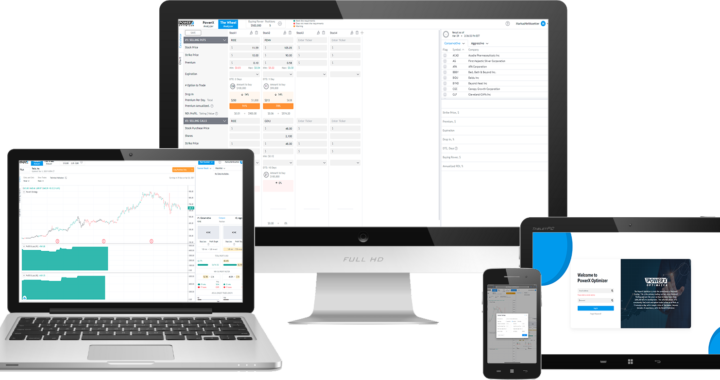

There are several ways to track the status of your tax refund. One way is to use cloud-based DIY tax preparation software, which allows you to access your return from any web-enabled device. You can also use mobile apps that will enable you to make payments and track your refund status. Online tax software is always available and backed up on secure servers. This eliminates operating system compatibility problems and ensures you have the latest software version.

The best online software includes side-by-side comparisons, reports, and tools for discussing tax planning with your clients. These features can save you a lot of money. When choosing the best software for your business, consider a few things: cost, customer reviews, software popularity, and available options for both technical and tax support. This will help you find the most affordable and easy-to-use solution for your company’s needs. If you have tax software that runs on a web browser, you can check the status of your return anywhere, at any time.

This means you can work on your returns while traveling, even if you don’t have a solid internet connection. Another benefit of cloud-based software is that it automatically updates when a new version is released. This ensures that you have the latest features and functionality at all times. Cloud-based software is accessible from any device running a web browser – PCs, laptops, tablets, or smartphones powered by any operating system. The best cloud-based tax software combines features and applications that allow your tax team to prepare returns quickly and efficiently. It also offers tools and features to help clients address various tax concerns.

How to Make a Payment

The most important thing about cloud-based DIY tax preparation software is that it backs up your returns on secure servers. If your hard drive fails or your operating system crashes, you won’t lose the data from your return. In addition, the best cloud-based programs can handle complex situations such as student loan interest and rental property income. They also provide valuable tools and tips to help you file your taxes correctly.

Another feature to look for in good tax software is the diagnostic tool. This allows the program to run tests and check for errors before filing your return. It will also ensure that your information meets your state’s legal requirements and determine whether you are eligible for income adjustments, tax deductions, or tax credits.

This will save you time and money in the long run because it can prevent errors from being filed incorrectly. The best cloud-based tax software will also have an excellent customer support team available through email and chat. This can be especially helpful for users with questions or who need software assistance.

The Ultimate Guide to Choosing the Perfect Retirement Community

The Ultimate Guide to Choosing the Perfect Retirement Community  What is FTMO Referral and How Does it Work?

What is FTMO Referral and How Does it Work?  How Monetarifund Can Help You Master Trading in 2023

How Monetarifund Can Help You Master Trading in 2023  SurgeTrader Audition: A Simple Way to Start Trading

SurgeTrader Audition: A Simple Way to Start Trading  PowerX Optimizer: The Ultimate Software for Finding and Executing Winning Trades

PowerX Optimizer: The Ultimate Software for Finding and Executing Winning Trades  Monument Traders Alliance Reviews: Is It Worth Joining?

Monument Traders Alliance Reviews: Is It Worth Joining?  The Art and Importance of Designing Safe and Effective Horse Jump Standards

The Art and Importance of Designing Safe and Effective Horse Jump Standards  The Art of Compromise: Resolving Family Disputes Amicably

The Art of Compromise: Resolving Family Disputes Amicably  The Benefits and Challenges of Sustainable Roofing for Commercial Buildings

The Benefits and Challenges of Sustainable Roofing for Commercial Buildings  Transforming Your Home with Terrazzo Flooring: A Timeless Choice for Elegance and Durability

Transforming Your Home with Terrazzo Flooring: A Timeless Choice for Elegance and Durability