5 Things to Know About Selling life Insurance for Final Expenses

Life Insurance text with business woman using a tablet

Many people need help figuring out how to pay final expenses. An insurance agent can help them find the right plan and plan for the future. If you want to help people through your career, consider working with a company that provides life insurance for final expenses.

With this job, you can give other people peace of mind by ensuring they can pay for end-of-life care. Keep reading to learn more about what it takes to become a final expenses insurance agent, why it’s an excellent fit for you, and how you can get started.

1. Understand Your Role as a Final Expenses Insurance Agent

The main job of a final expenses insurance agent is to protect your clients from unexpected costs that come up when someone dies. This includes the costs of the funeral, the last medical bills, and other death-related debts.

You must also be willing to educate your clients on the different types of final expense insurance. Your task is to explain the benefits and drawbacks associated with each.

2. Know Your Clients and Their Needs

Knowing your client’s needs is essential as a final expenses insurance agent. Understanding your client’s situation is vital so you can make the best recommendations to them. This will also let you give them the best coverage that fits their way of life and financial security.

Have them figure out what they own and what they owe to make a good decision. Also, knowing the client’s financial goals and limits can help develop a plan that meets their needs and stays within their budget.

3. Develop Your Techniques in Selling Life Insurance for Final Expenses

You need to work on your sales skills to sell this insurance. You should become knowledgeable about insurance policies, build relationships with potential clients, communicate effectively, and offer competitive rates and terms.

It is also essential to know how final expense insurance policies affect taxes and to be able to explain these effects to clients. You can learn all of these through undergoing a final expense training.

4. Learning How to Handle Objections

It is crucial to handle any objections the customer may have regarding the product, such as the price or the need for coverage. This can be done by providing clear, concise explanations of the product and its value and understanding where the customer is coming from in their objections.

5. Developing Your Sales Script

The agent should develop a strong sales script that includes situations in which a final expense policy is appropriate. By knowing a lot about the products and how to sell them, agents can better give good advice and help their clients choose the best policy. So, with continuous learning and practice, excellence is within your reach!

Ready to Start Your Journey Of Helping People?

Being a final expenses insurance agent is a great career choice. If you’re passionate about helping those in financial distress, offering life insurance products that address final expenses can lead to meaningful work, job satisfaction, and financial stability.

Finally, if you want to enter or expand your business, taking the time to learn about life insurance for final expenses insurance is worthwhile. Get started today, and contact a local agent for more information.

You can also find more great articles on various topics by exploring the rest of our blog.

The Ultimate Guide to Choosing the Perfect Retirement Community

The Ultimate Guide to Choosing the Perfect Retirement Community  What is FTMO Referral and How Does it Work?

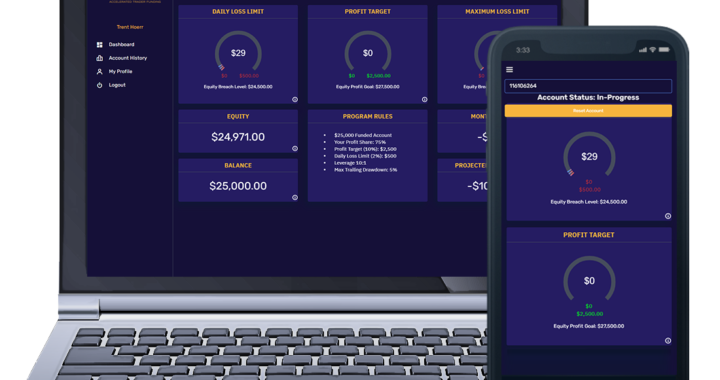

What is FTMO Referral and How Does it Work?  How Monetarifund Can Help You Master Trading in 2023

How Monetarifund Can Help You Master Trading in 2023  SurgeTrader Audition: A Simple Way to Start Trading

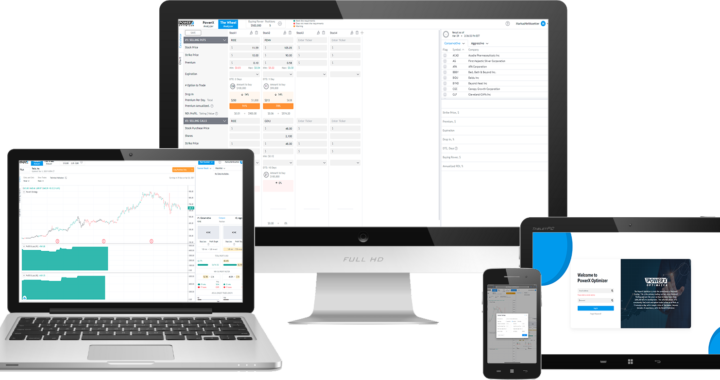

SurgeTrader Audition: A Simple Way to Start Trading  PowerX Optimizer: The Ultimate Software for Finding and Executing Winning Trades

PowerX Optimizer: The Ultimate Software for Finding and Executing Winning Trades  Monument Traders Alliance Reviews: Is It Worth Joining?

Monument Traders Alliance Reviews: Is It Worth Joining?  The Art and Importance of Designing Safe and Effective Horse Jump Standards

The Art and Importance of Designing Safe and Effective Horse Jump Standards  The Art of Compromise: Resolving Family Disputes Amicably

The Art of Compromise: Resolving Family Disputes Amicably  The Benefits and Challenges of Sustainable Roofing for Commercial Buildings

The Benefits and Challenges of Sustainable Roofing for Commercial Buildings  Transforming Your Home with Terrazzo Flooring: A Timeless Choice for Elegance and Durability

Transforming Your Home with Terrazzo Flooring: A Timeless Choice for Elegance and Durability